Eitc Income Limits 2024 For Single Person

Eitc Income Limits 2024 For Single Person. If you have a kid or have. — for 2024, the amount of the eitc and the income thresholds have been adjusted to reflect inflation and other economic factors.

— [updated with 2024 irs adjustments] below are the latest earned income tax credit (eitc) tables and income qualification. If you pass all these tests, you could.

Eitc Income Limits 2024 For Single Person Images References :

Source: lanabteriann.pages.dev

Source: lanabteriann.pages.dev

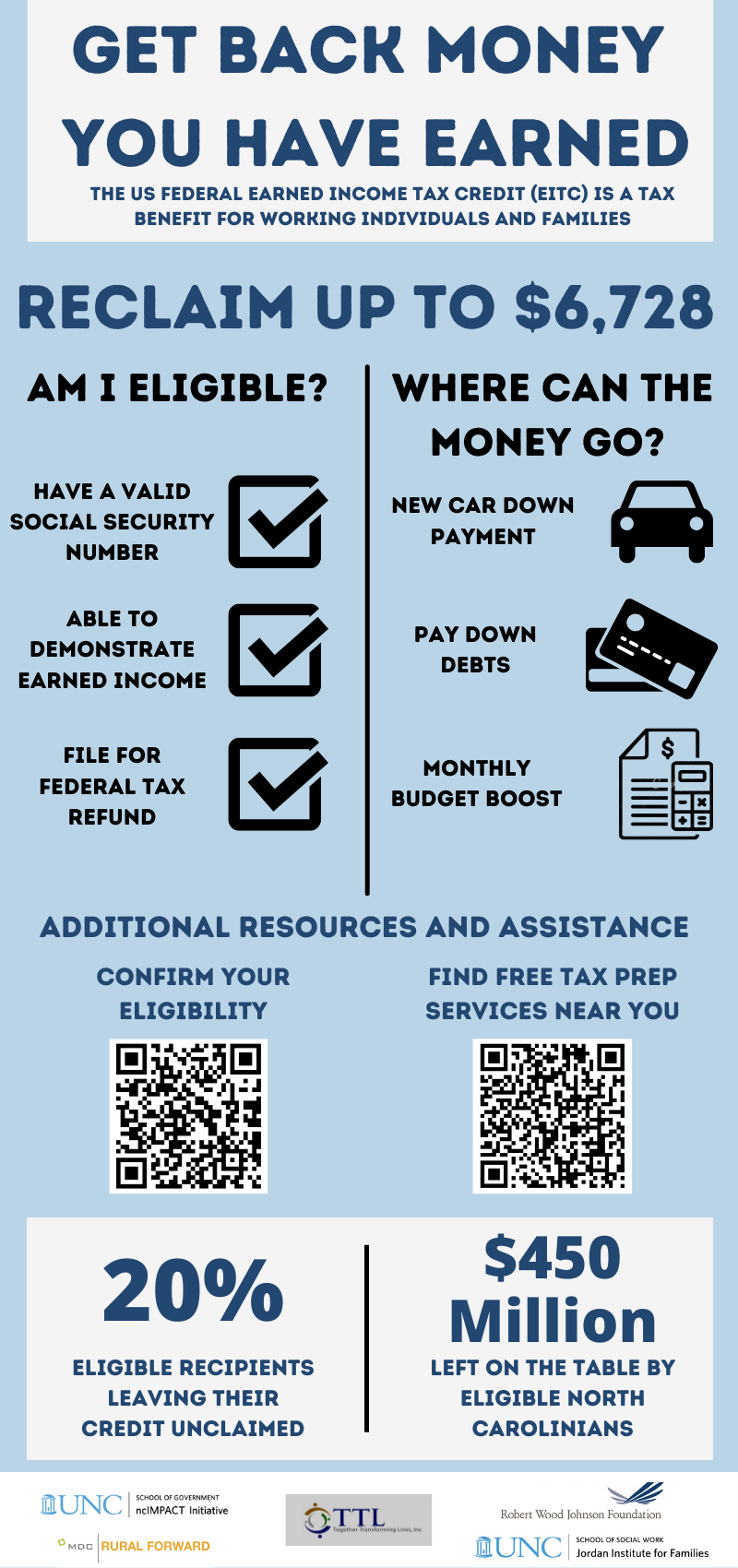

What Is The Eitc Limit For 2024 Rina Veriee, The earned income credit (eic) is a refundable tax credit available to working individuals with low to moderate incomes.

Source: fabalabse.com

Source: fabalabse.com

Can a single person get the earned credit? Leia aqui What is, Curious if you're going to earn the earned income tax credit this year?

Source: nertabcelestine.pages.dev

Source: nertabcelestine.pages.dev

Irs File Taxes 2024 Hedy Ralina, Find if you qualify for the earned income tax credit (eitc) with or without qualifying children or relatives on your tax return.

Source: cwccareers.in

Source: cwccareers.in

600 Earned Tax Credit 2024 Know Limit & EITC Refunds Date, However, a single person with one.

Source: mungfali.com

Source: mungfali.com

Earned Tax Credit Flow Chart, Here's who qualifies and how to claim the credit.

![What to expect for the 2024 tax filing season [Video] What to expect for the 2024 tax filing season [Video]](https://s.yimg.com/ny/api/res/1.2/NOJGXm_PWFWbewu3hlmwGg--/YXBwaWQ9aGlnaGxhbmRlcjt3PTEyNDI7aD03NzE-/https://media.zenfs.com/en/aol_yahoo_finance_433/dfc43ca8cfe1153c83f930278227bab3) Source: www.aol.com

Source: www.aol.com

What to expect for the 2024 tax filing season [Video], The earned income tax credit (eitc) is a federal tax credit.

Source: taxfoundation.org

Source: taxfoundation.org

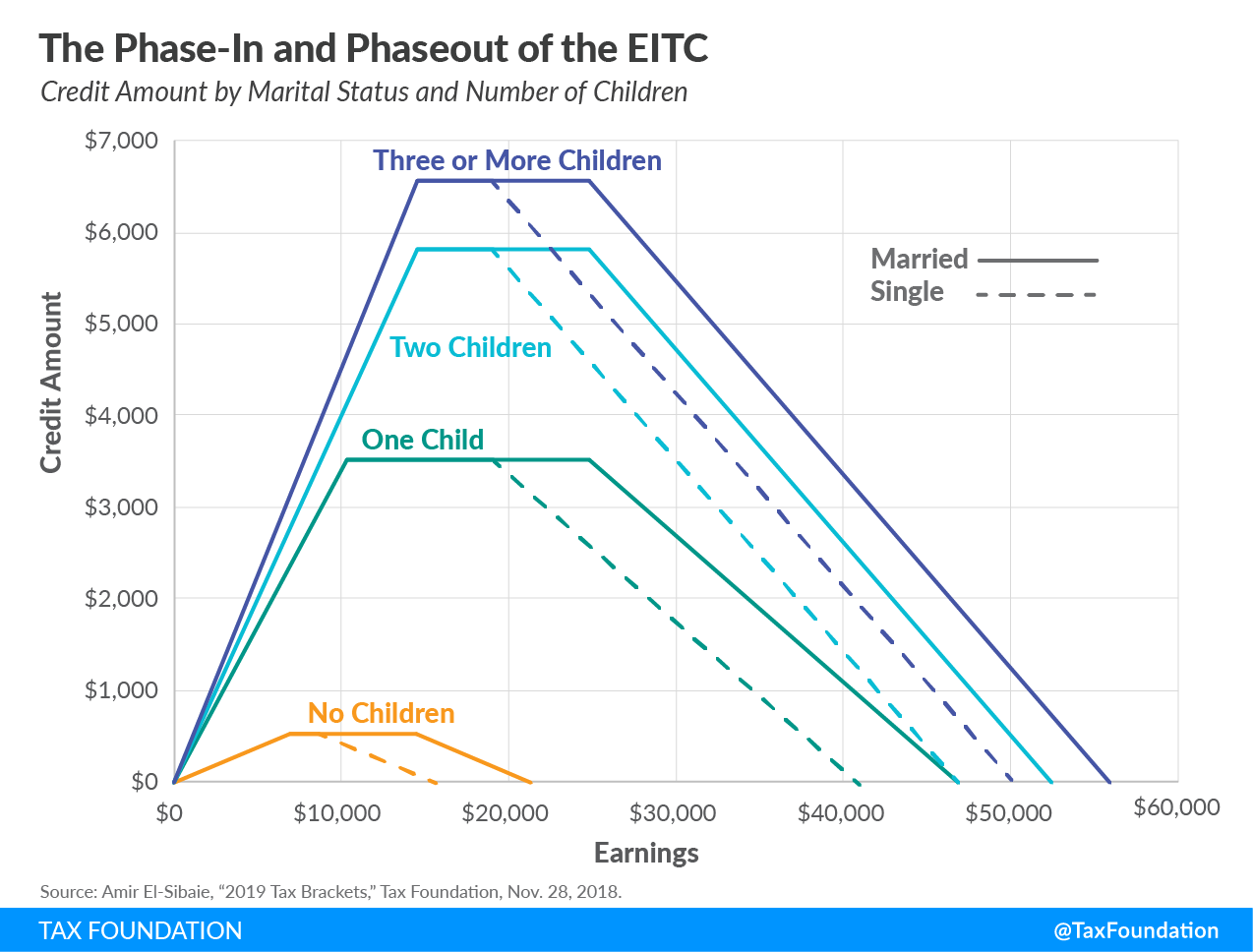

The Earned Tax Credit (EITC) A Primer Tax Foundation, — the amount of the eitc depends on the amount you earned from working for someone or for yourself, whether you are married or single, and the number of.

Source: taxfoundation.org

Source: taxfoundation.org

Earned Tax Credit (EITC) A Primer Tax Foundation, — [updated with 2024 irs adjustments] below are the latest earned income tax credit (eitc) tables and income qualification.

What to expect for the 2024 tax filing season Business News, The following table provides a.

Fewer Americans will qualify for this overlooked, but valuable tax credit, — see who qualifies for the eitc.

Category: 2024